- The ) However, …

- Rates is changeable, since they are with many HELOCs They’re going along for the U.S. Prime Rate. During so it composing, brand new Federal Set aside is considered multiple rate nature hikes

- No software, origination, otherwise inactivity charge however, there may be others. Navy Federal says, “Having loan levels of doing $250,100000, settlement costs one to people need to pay usually range from $300 and $dos,000”

- You can have an excellent 20-year “draw” several months, during which you might use and you will pay back as you want. However the “repayment” period kicks inside at the beginning of seasons 21, and after that you can only pay down what you owe, zeroing they because of the 12 months 40.

* Interest levels quoted into the Navy Federal’s website into the varied out-of 5.00% to have a good 70% LTV to six.50% having a great 95% LTV. Follow this link getting a larger list of decide to try cost. The pace you’re offered are different dependent on your credit score and you will present debt obligations. Please remember: Speaking of adjustable pricing.

Once more, Navy Federal’s HELOC looks is an excellent offering. While you are qualified, you ought to get a bid also of them from other loan providers. Don’t be astonished if this sounds like an informed you earn.

With just 350 towns,186 from which take or near army installations, you’re unable to come across a beneficial Navy Federal part close where you happen to live. However, read the site’s department locator.

Of course, immediately, of many financing applicants want to performs of the mobile phone (1-888-842-6328) otherwise from lender’s web site otherwise application. And you can Navy Government do well with all people.

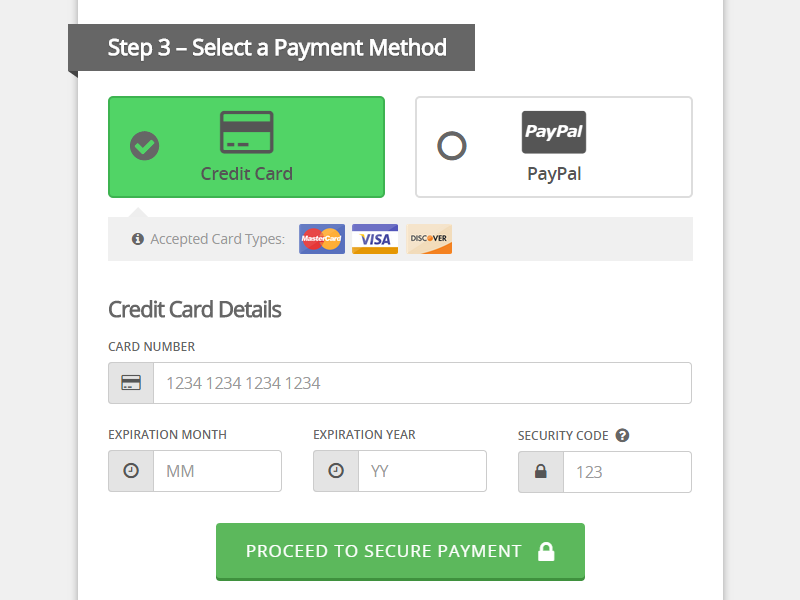

Begin the site for the beneficial Tips Sign up for a property Collateral Financing otherwise Line of credit webpage. One treks you through the process and you can goes toward normal timeline.

Navy Government Credit Partnership Specialist and you can Individual Evaluations

We went to ten websites that provide user and expert feedback away from economic teams. Of these that offered superstar studies, the common score was 3.8 regarding a prospective four.

Although not, one to had merely three individual evaluations, a couple of regarding disgruntled people. If you take out you to definitely lightweight sample, the common across the kept of these was 4.54 celebs.

That seems to align with the help of our examine you to Navy Government generally provides advanced level customer support. And is borne out-by the get regarding J.D. Fuel 2021 You.S. Top Mortgage Origination Pleasure StudySM, hence polled 5,414 people. They arrived 8th for client https://www.cashadvancecompass.com/personal-loans-va/alberta satisfaction among good luck home loan loan providers, over the world average.

Of course, any company with eleven billion people will troubled specific. However, Navy Government goes wrong less and pleasures many more.

Navy Government Borrowing Union Positives

- High customer care

- An over-all selection of financial services and products, plus family equity financing and you will HELOCs

- Highly regarded mobile app and you may strong site which have high features

Navy Government Borrowing from the bank Relationship Disadvantages

- Subscription is not offered to the

- Restricted part circle

This type of wouldn’t bother the individuals entitled to sign-up until both alive a long way off a branch and you can dislike the newest development.

Navy Federal Borrowing Partnership Selection

Just because we love the fresh Navy Government Borrowing Connection domestic guarantee financing and you will HELOC, that does not indicate those types of is the best for you. It could really turn out that way. Nevertheless have to make sure.

Rates on these factors are different generally anywhere between loan providers. And it’s feasible for you will be given less you to by one of Navy Federal’s opposition.

Very setting a great shortlist of the many lenders that will be a beneficial individuals. And inquire for every to own a quote. It is easy upcoming evaluate your even offers side-by-side and you will choose the contract which is best for you.

- Loan credit constraints start around $ten,100000 to help you $five-hundred,100000